- The Policy Dispatch

- Posts

- Digital Africa

Digital Africa

How to achieve higher mobile phone ownership in SSA?

The Policy Dispatch #7 [9th March 2025]

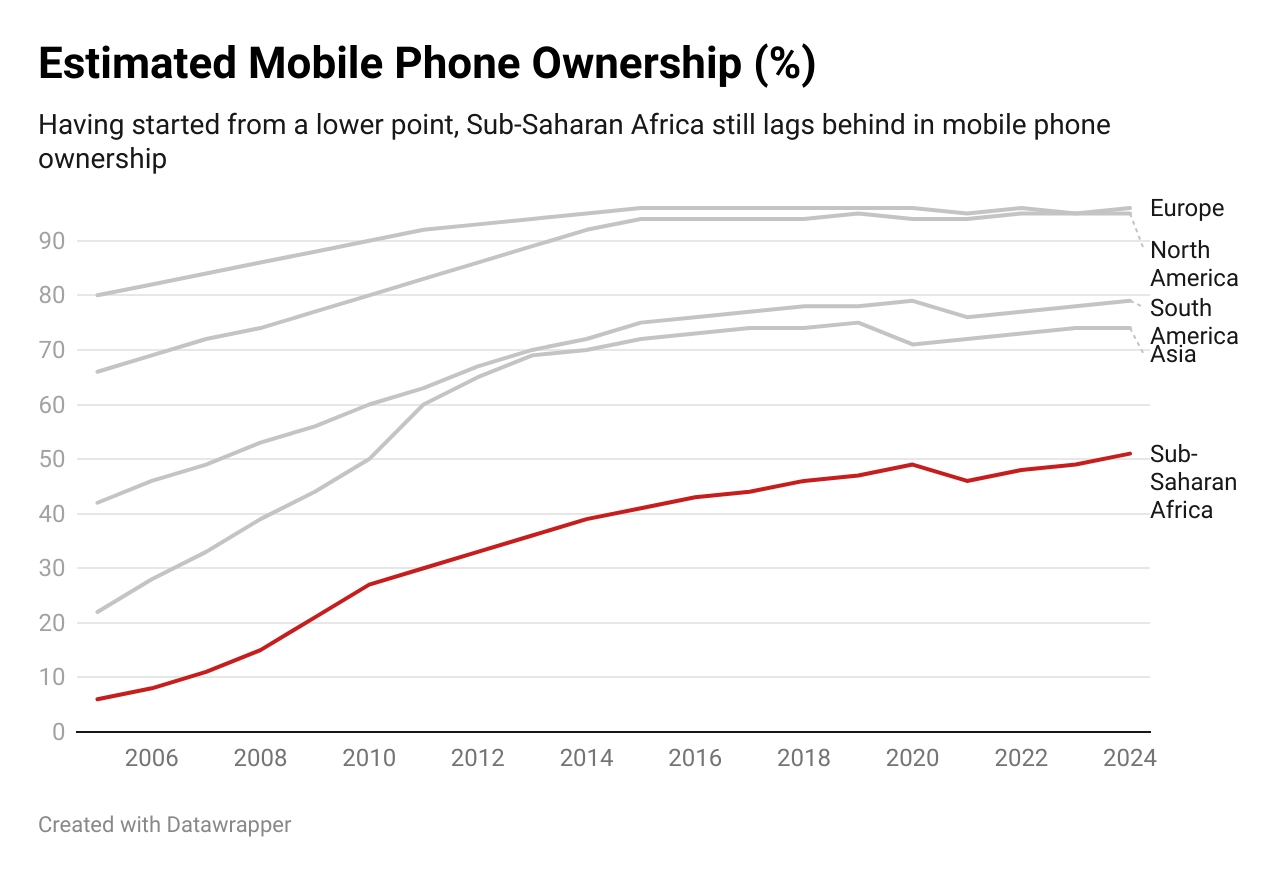

This week, it is all about the digitalisation of Sub-Saharan African countries. The continent has witnessed rapid mobile ownership growth but more needs to be done. An estimated $100 Billion of investment will be required to achieve more than 80% ownership and to expand the network. Beyond that, Tech companies

⏱️ In Today’s Dispatch:

📱 Mobile Ownership

🖥️ Tech companies tax bill

📰 Policy News recap

Mobile Ownership

In a world where smartphones are everywhere, Sub-Saharan Africa still lags behind – only about 50% of people having a mobile. The reasons range from affordability and coverage to digital skills and policies, but governments are stepping up with solutions.

💰️ Affordability: The high cost of mobile devices and services remains a significant barrier. For instance, in South Africa, MTN launched the MTN Icon 5G smartphone at 2,499 rand (approximately $138) to make 5G technology more accessible. Despite such efforts, the cost remains prohibitive for many, especially in rural areas.

High Deployment Costs

🌍Geographical Barriers: The vast and often challenging terrains increase the cost and complexity of deploying mobile infrastructure in remote areas. Sub-Saharan Africa’s mobile network infrastructure is notably thinner on the ground than South America’s. Industry data estimate around 80,000 active mobile towers across all of Sub-Saharan Africa as of 2022. In comparison, the countries of South America (and nearby Latin American nations) have well over 190,000 mobile towers deployed – more than double the number in SSA

🏗 Energy Infrastructure: Unreliable or non-existent power grids necessitate alternative energy solutions, such as solar-powered base stations, to maintain network operations.

📜 Regulatory Hurdles: Complex licensing processes and inconsistent policies across countries can delay infrastructure development and deter investment.

Technological Limitations

📡 Bandwidth Constraints: Limited availability of high-capacity bandwidth affects the quality and speed of mobile services, particularly in underserved regions.

📡 Technology Adoption: The slow rollout of advanced technologies like 4G and 5G restricts access to high-speed internet services, impacting user experience and digital inclusion. About 85% of Sub-Saharan Africa’s population lives within a 3G network footprint, leaving roughly 15% with no mobile broadband signal. The 4G/LTE rollout in Sub-Saharan Africa is improving but still lags far behind. As of 2022, about 65% of the region’s population was covered by a 4G network. Next-generation 5G is in its infancy in Africa. Sub-Saharan Africa had only ~3% 5G population coverage by 2022

In 2024, Africa experienced a record number of internet shutdowns, often as a political tool to suppress protests and dissent. This has hindered digital growth, created uncertainty for investors, and disrupted businesses.

Government Initiatives

Despite these challenges, various initiatives aim to enhance mobile connectivity:

🚧 Infrastructure Development: Nigeria’s National Broadband Plan targets 90% 4G coverage by 2025. Kenya's collaboration with Alphabet's Loon project utilized high-altitude balloons to provide internet access to remote areas, showcasing innovative approaches to infrastructure challenges.

✅ Affordable Devices: Rwanda cut import duties on smartphones to lower prices and Uganda gives tax incentives to telcos expanding rural networks.

💡 Digital Literacy Programs: Ghana's "DigiLearn Initiative" integrates digital skills into school curricula, equipping students with essential competencies for the digital age.

⭐ Mobile Money Services: Kenya's M-Pesa platform has increased financial inclusion, promoting cashless payments.

🙌 Internet Freedom and Regulation: Policies safeguard connectivity. Ghana and Kenya pledge no internet shutdowns during elections, and courts have declared shutdowns illegal (ECOWAS court on Nigeria’s Twitter ban).

Achieving over 80% mobile phone ownership and >90% coverage in Sub-Saharan Africa will require an estimated $100 billion investment. About 80% of this funding will focus on infrastructure, including 250,000 new mobile towers(costing $100,000–$200,000 per site), 250,000 km of fiber optic cable, and expanded 3G/4G coverage. Another $20 billion will be needed for affordability programs, including subsidies to reduce smartphone costs, digital literacy initiatives, and incentives for operators to expand in rural areas.

Tech giants’ tax bill 💲

For years, Google and Microsoft have made billions from African consumers while paying minimal taxes in the region. But that’s starting to change as governments crack down on digital giants.

Take Nigeria: After introducing a 7.5% VAT on digital services and a new "Significant Economic Presence" rule, foreign tech firms like Microsoft and Google paid ₦1.98 trillion in just six months. Meanwhile, South Africa has been collecting VAT on foreign e-services since 2014, generating R600 million (~$40 million) annually from companies like Google.

But here’s the twist 🔀: these companies have long avoided major tax bills by routing African revenue through offshore entities, claiming they lack a "physical presence." Clever legal maneuvers kept their corporate tax bills low, while VAT often went uncollected due to weak enforcement.

Now, African nations are fighting back 💪. Countries like Zimbabwe, Uganda, and Cameroon have introduced new digital tax policies, and some are demanding a fairer share under global tax reforms.

For governments, these efforts aren’t just about revenue — it’s about fairness. After all, why should billion-dollar tech firms profit from African markets without contributing their fair share?

News recap

The United Nations has updated economic measurement rules to include wind and wave power, along with data, in GDP calculations starting in 2030. This aims to reflect the growing significance of renewable energy and digital assets. While this change may increase GDP figures statistically, it won't directly alter material wealth or tax revenue. Countries with significant renewable energy and data sectors may see notable impacts.

Nigeria's inflation rate dropped to 24.48% in January following a rebasing of the price index (first one since 2009), which updated consumption patterns. The change, aimed at reflecting current inflation pressures, may prompt a rate cut.

The Central Bank of Nigeria (CBN) plans to curb inflation by adopting an inflation-targeting framework, replacing the previous exchange rate-focused strategy. This approach aims to restore purchasing power, stabilize prices, and enhance investor confidence. Measures include FX reforms, improved financial inclusion, and strengthening the banking sector.